179 vehicle deduction calculator

Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s taxable. Limits of Section 179.

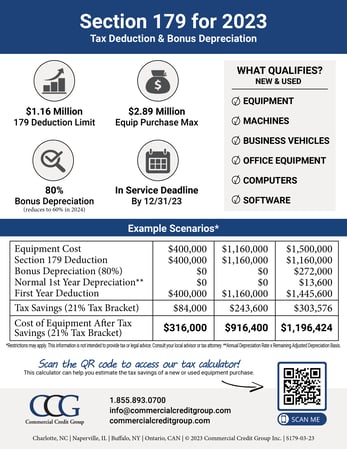

Section 179 Calculator Ccg

The deduction allowance is.

. The Section 179 Deduction is now 1000000 for 2019. The IRS has specific guidelines on Sport Utility and Certain Other Vehicles. Section 179 Deduction Calculator.

There is also a limit to the total amount of the equipment purchased in one year ie. This easy to use calculator can help you. Section 179 does come with limits there are caps to the total amount written off 1080000 for 2022 and limits to the total amount of the equipment purchased.

The total amount that can be written off in Year 2020 can not be more than 1040000. Use this Section 179 Deduction Calculator to See How Much You Can Save. The full deduction is 1050000 with additional possible savings The Section 179 deadline for 2021 is 123121 at 1159 PM and a put in use requirement applies.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. Equipment Financing for My Business. Make your pharmacy more productive profitable when you use this tax benefit with Parata.

Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. The benefit of purchasing. This means businesses can deduct the full cost of equipment from their 2019 taxes up to 1000000 with a total equipment.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Section 179 calculator for 2022. You can get section 179 deduction.

Under the Section 179 tax deduction you are able to deduct a maximum of 1080000 in fixed assets and equipment as a form of business expense. The Section 179 deduction limit for 2022 has been raised to 1080000. The benefit of purchasing a heavy vehicle is that the deduction limit for Section 179 is 25000 which is more than double what you can deduct for smaller vehicles.

Section 179 does come with limits - there are caps to the total amount written off 1050000 for 2021 and limits to the total amount of the equipment purchased. Make your pharmacy more productive profitable when you use this tax benefit with Parata. Typically light vehicles include passenger vehicles cars small and light crossover SUVs and small pickup trucks and small utility trucks.

Section 179 can save your business money because it allows you to take up to a 1080000 deduction when purchasing or leasing new machinery. Section 179 Deduction Calculator. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

Make your pharmacy more productive profitable when you use this tax benefit with Parata. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. Section 179 calculator for 2022 Enter an equipment cost to see how much you might be.

When Section 179 Deduction was first enacted it did not. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save. Lets say you buy a cargo.

Limits of Section 179. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and used equipment and software placed into service during the tax.

Section 179 Tax Deduction Calculator Internal Revenue Code Simplified

Bellamy Strickland Commercial Truck Section 179 Deduction

Section 179 Calculator Ccg

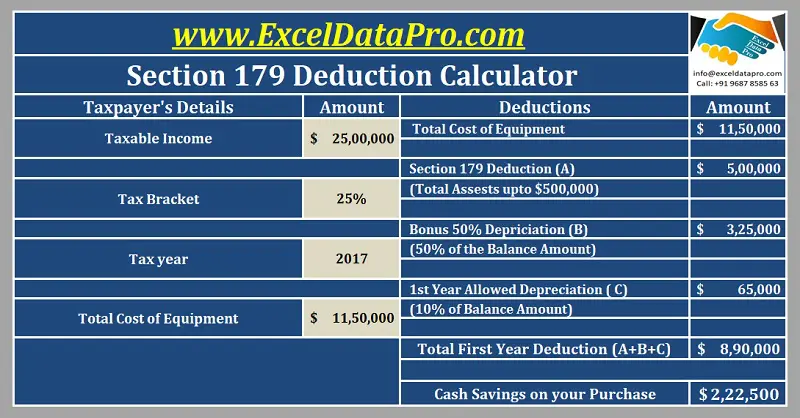

Download Section 179 Deduction Calculator Excel Template Exceldatapro

Free Self Employment Tax Calculator Shared Economy Tax

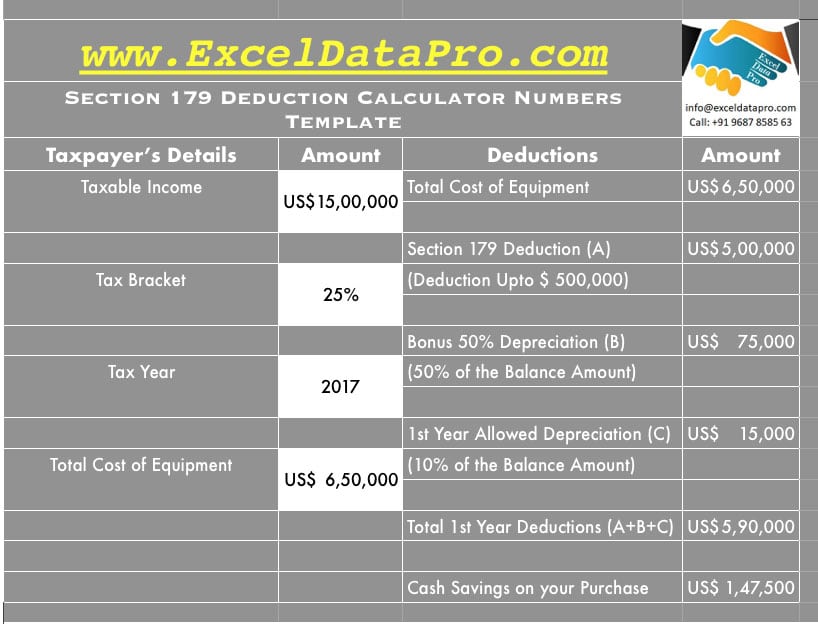

Download Section 179 Deduction Calculator Apple Numbers Template Exceldatapro

Section 179 For Small Businesses 2021 Shared Economy Tax

Calculate Your Potential Section 179 Tax Deductions On New Equipment Bpi Color

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179 Deduction Hondru Ford Of Manheim

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Deduction 2022 Topmark Funding

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Section 179 Irs Tax Deduction Updated For 2022

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek

Ready To Use Section 179 Deduction Calculator 2021 Msofficegeek